Are Warner Music Group shares a good long-term investment?

Jared Tarin/Getty Images Entertainment

Warner Music Group (WMG) is one of the three major record labels. After a long period of industry consolidation, the music market has been content with having only three major labels, namely WMG, Universal Music Group (OTCPK:UMGNF), and sony (SONY) Subsidiary of Sony Music.

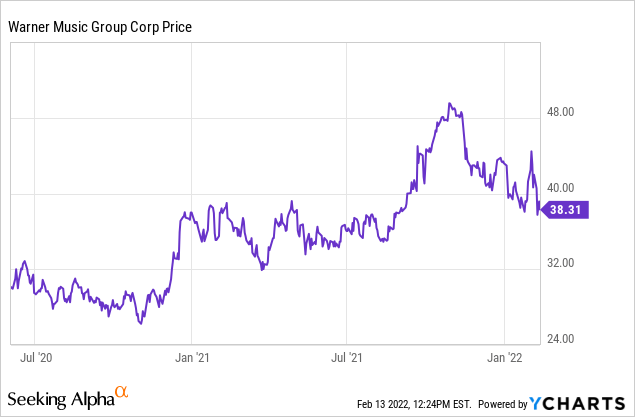

WMG completed its IPO to little fanfare in 2020. Shares opened around $30 and stayed there for quite a while. However, thanks to the pandemic-induced streaming boom, Warner posted strong results in 2021 and shares rose significantly last fall.

It wasn’t just Warner’s own results that sparked excitement. Additionally, main rival Universal also went public. He did it in a roundabout way. He was supposed to merge with famed investor Bill Ackman Pershing square tontine (PSTH) SPAC. However, this deal was complicatedly structured and did not withstand regulatory scrutiny.

Eventually Universal went public in Europe, rather than merging with Ackman’s SPAC. Either way, Ackman’s involvement shone a light on the music industry. Since the early 2000s, most investors considered her untouchable; music revenues had plummeted as compact disc sales declined due to rampant piracy.

With the rise of streaming services such as Spotify (SPOT), however, everything has changed. Music labels now get the majority of their revenue from Spotify and competing services, and as these continue to grow, they’re also pumping more money into record company coffers. Ackman’s involvement with Universal has woken up investors that labels are good business again. So, with that in mind, is WMG stock an attractive buy after its recent correction?

Will Warner Music Group shares rise in the long term?

I would say that probabilities favor long-term appreciation. The case for this is quite simple, yet powerful.

The global recorded music industry reached its peak around the turn of the century. In the late 1990s, labels had the best of all worlds. They made a fortune by reissuing their old catalogs on compact discs, forcing anyone who had collected records to buy the same album twice. Meanwhile, new rising trends of this era such as boy bands and hip-hop caused a massive demand for new music at the same time.

Between 2001 and 2010, however, the good times came to an end. Global music industry revenues have fallen from $24 billion a year to just $15 billion. And it’s not even adjusted for inflation. Just as other types of media such as newspapers and magazines seemed ill-equipped to survive on the Internet, music sales experienced a precipitous decline as people downloaded music, often illicitly and for free. In the event that people were buying digital music, they would often just buy individual songs for $1.29 a pop instead of buying a CD for $15 like the good old days.

Streaming, however, reversed the negative trend. Global music revenues hit a low of $14.0 billion in 2014. They rebounded to $21.6 billion in 2020. So overall, music revenues are still down significantly compared to twenty years ago, especially when adjusted for inflation. However, things are clearly on an upward trajectory and analysts expect streaming to continue growing at a healthy pace for at least the next few years.

Streaming accounts for around two-thirds of recorded music revenue in 2020, with physical sales and performing rights being the next largest contributors. It’s also worth noting that labels started making money in other ways; with 360 deals, for example, labels can participate in an artist’s revenue from concerts, merchandise, and other ancillary revenue streams.

Is WMG stock a buy, sell or hold?

I see Warner Music in the hold category, especially with the stock pulling back from its recent highs.

I would have had a hard time justifying holding WMG stock when it hit close to $50 last fall. However, here at $38, valuation is less difficult.

I see Warner as a long term royalty on the music industry. Of course, there is operational activity around the signing, development and promotion of new artists. However, more and more revenue streams seem to come from managing the back catalog and harnessing its full potential on the wide array of emerging platforms for everything from TikTok to Platoon (PTON) style fitness classes.

However, I see a more difficult short-term outlook for Warner. Much of Warner’s huge revenue growth last year was driven by the home quarantine situation. Services such as Spotify and Peloton have registered tons of new users; engagement exploded as people were taken away from other traditional entertainment and fitness options.

As we’ve seen this earnings season, however, the tailwind for streaming services has quickly died down. netflix (NFLX) collapsed following a significant slowdown in its growth trajectory. Spotify stock also lost ground after its latest earnings report. And Peloton resorted to a major cost-cutting campaign following a drop in demand for its bikes.

These types of services were huge factors pushing WMG’s growth at the margin. And now, growth is expected to decelerate sharply, at least over the next 12 months.

In the longer term, labels are good business. The streaming world has restored the value of music-based intellectual property, and it looks like piracy will no longer be a major threat to the industry’s outlook.

However, at some point, the growth will come to fruition for music streaming. In developed markets, anyway, most people who are going to get Spotify or Apple Music (AAPL) subscriptions probably already have. Meanwhile, as weaker streaming services leave the playing field, expect Spotify to negotiate a tougher royalty-sharing deal with labels.

These factors point to a steady stream of earnings, but not the kind of rapid growth we’ve seen in recent years. I expect people to be a little over-informed about the outlook for music streaming royalties given recent strong results. But I expect it to be a low growth business in the long run. The amount of music consumed around the world isn’t changing too quickly, and partners like Spotify also need to turn a profit at some point to appease their investors. I don’t know how much more of the music pie labels can keep for themselves, and meanwhile, overall music revenue growth is expected to slow.

How much is Warner Music Group worth?

WMG stocks at 30x forward earnings and 25x EV/EBITDA just doesn’t scream a bargain at me. This is about a 3% return on earnings and 4% on EBITDA from a business that I hope will see mid-single-digit growth in the longer term. I may be underestimating how long streaming platforms are able to sign up more subscribers. Even if that’s the case, however, owning SPOT stock seems like a cleaner way to play the trend than music labels, at least given their current valuations.

I would be more interested in Warner stocks around 20x EBITDA and less than 25x forward earnings. From there, I think investors would do well, even in a base case scenario where EPS is only growing by, say, 6%/yr. And if Warner were to surprise on the upside and sustain double-digit growth for an extended period, investors would be amply rewarded.

My target entry price to buy WMG stock at these multiples is around $31, which is around the current 52-week low for the stock.

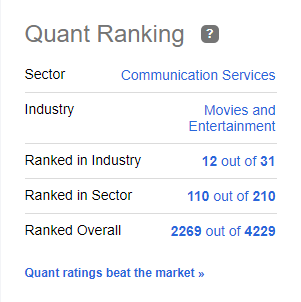

Seeking Alpha’s quantitative ratings are also consistent with my neutral view of Warner Music’s outlook:

Quantitative WMG (Seeking Alpha) Rankings

WMG stock ranks slightly above average in its film and entertainment industry, but sits just around the median relative to its broader industry and the broader market.

That seems about right. Warner Music’s valuation is much more reasonable than it was a few months ago. It is appropriate to hold shares at this stage. However, especially with so many stocks in a steep correction right now, Warner would have to drop much more to be in a place where I would like to allocate new capital today.

Comments are closed.