Warner Music Group Stock: Slow but Steady (NASDAQ:WMG)

Rich Fury/Getty Images Entertainment

There is only one pure play music label on the US stock market, and that company is Warner Music Group (NASDAQ: WMG). This iconic music publisher, which has produced new and old artists ranging from Joni Mitchell and Madonna to Ed Sheeran and Lizzo, fell in sympathy with the rest of the Fellowship this year, despite the fact that 2022 was supposed to be her big comeback (diminishing COVID pressures would make it easier for concerts and festivals to return, which are huge drivers of music sales).

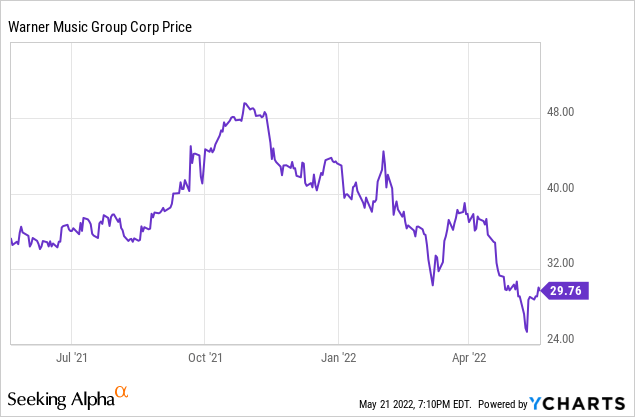

Year-to-date, Warner Music Group shares have corrected more than 30%. This is despite the company continuing to deliver strong results, especially capturing its burgeoning market in music streaming. Now is a good time, in my opinion, for investors to re-evaluate the bullish thesis of this stock.

Let’s go back for a second: this year, the Stock Exchange really punished the distributors of streaming content. Netflix (NFLX) and Spotify (SPOT), two of the market’s leading pure-play content distributors, each lost more than half of their market value. The main concern here is competition hampering subscriber growth – Netflix, for example, has seen a rare turnover in its user numbers in the US, likely due to the flood of streaming options now available. on the market.

But even as video and music content distributors continue to compete for subscribers, one thing is clear: the main differentiator between platforms is content. And so, ultimately, investors should bet on companies that have access and ability to create content. Warner Music Group is exactly that in the music world.

Music, it goes without saying, is fundamental to our daily lives. Most of us now pay for streaming accounts. We watch videos with music playing in the background, for which labels like Warner Music Group get a cut. When we ignore the short-term noise and look at the long-term picture, I see no future in which Warner Music Group does not thrive.

I keep on staying bullish on Warner Music Group and encouraging investors to buy the recent drop. Here’s a rundown of why I’m bullish on the company:

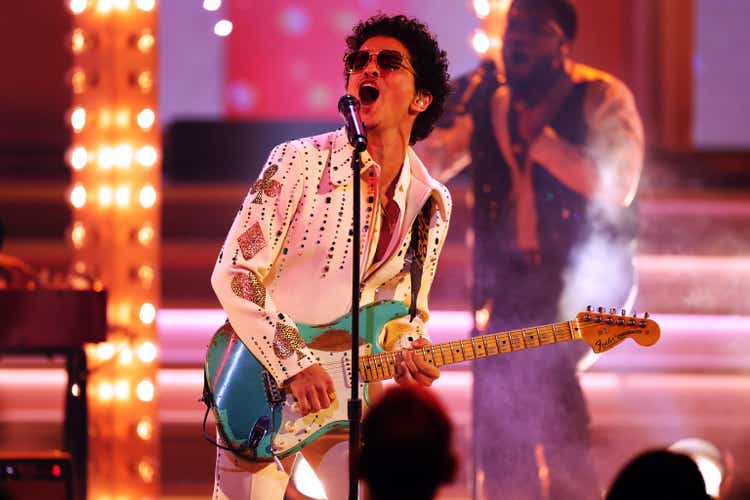

- Strong artist discovery machinery. Warner Music Group has discovered and produced some of today’s best-known artists. The company continues to create and monetize new content. For example, the company produced new duo Silk Sonic (combining existing stars Bruno Mars and Anderson .Paak) which won four Grammy awards this year, including Record of the Year.

- Social media platforms, especially TikTok, need music to generate content. Warner Music Group signed a major deal with TikTok in December to provide music for its videos. While there’s no dollar figure attached to the deal, Warner noted that social media brings in “hundreds of millions of dollars a year” in revenue, which is still a small but growing part. fast, with an annual revenue base of approximately $4 billion.

- Fitness classes are another source of digital income. Payment for music content is one of Peloton’s largest expenses. As Peloton’s success spurs more and more imitators, expect online fitness to continue bolstering its demand for music.

- Music festivals are making a comeback. After a hiatus due to the pandemic for the past two years, music festivals are returning. Coachella, in particular, happened last month. A full line-up of regular concerts throughout the year will put music back in the spotlight and drive revenue growth.

Finally, it should be mentioned that Warner Music Group offers a healthy dividend to attract patient investors. At $0.15/quarter or $0.60/year, Warner Music Group’s roughly 2% dividend is not to be overlooked.

From a valuation perspective: At the current share price near $30, Warner Music Group trades at a market capitalization of $15.32 billion. After offsetting $385 million in cash and $3.83 billion in debt on the company’s most recent balance sheet, Warner Music Group’s earnings the enterprise value is $18.76 billion.

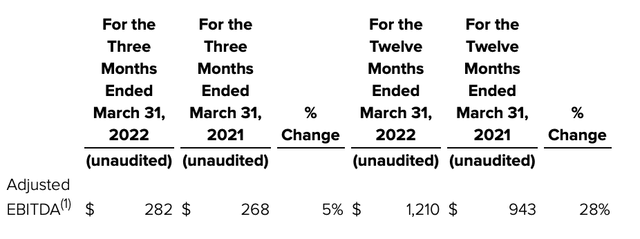

Warner Music Group Adjusted EBITDA (Warner Music Group second quarter results release)

Compared to the company’s trailing twelve-month adjusted EBITDA of $1.21 billion, Warner Music Group trades at 15.5x adjusted EBITDA EV/LTM. If we assume that Adjusted EBITDA growth can keep pace with Warner Music Group’s current revenue growth rate of around 10% per year, its forecast multiple would be around 14.1x Adjusted EBITDA EV/FTM, assuming forward year-over-year EBITDA of approximately $1.33 billion.

While that doesn’t exactly scream “value” just yet, I think the sticky nature of Warner Music Group’s revenue streams and the uniqueness of its music publishing business give the stock a premium.

In other words, stay here long: I see a way for Warner Music Group to recoup the $40.

Download Q2

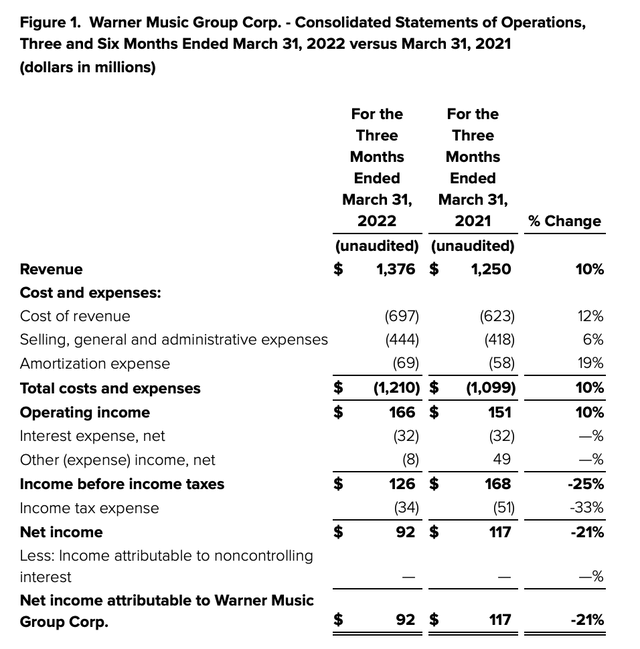

Now let’s talk more about Warner Music Group’s latest quarterly results. The summary of the results for the second quarter of the fiscal year (March quarter) is presented below:

Warner Music Group second quarter results (Warner Music Group second quarter results release)

The company has achieved solid revenue growth, at least for a “legacy” company that has been around for decades. Revenue rose 10% year-on-year to $1.38 billion, beating Wall Street expectations of $1.37 billion (+9% year-on-year). Note that in the absence of currency fluctuations, Warner Music Group’s constant currency revenue growth would have been even stronger at 13% year-on-year.

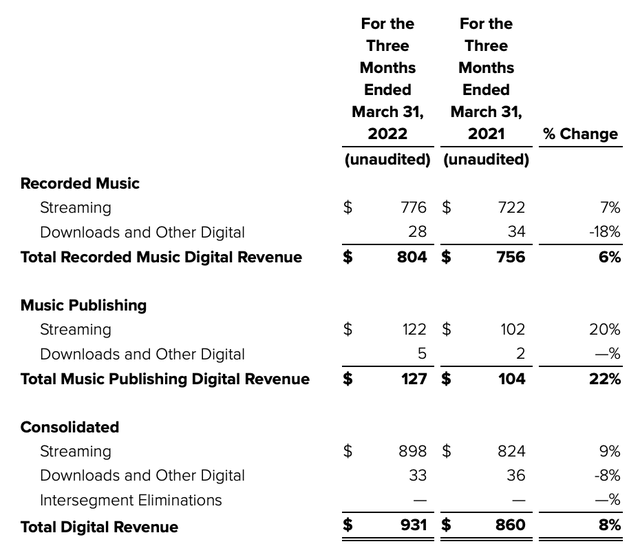

See an alternate revenue breakdown in the table below. Streaming, now Warner Music Group’s biggest source of revenue, grew 9% year-over-year to $898 million in the quarter, roughly two-thirds of the company’s total:

Warner Music Group Revenue Breakdown (Warner Music Group second quarter results release)

Also note, however, that even vintage music formats are still in high demand. Physical music revenue increased 3% year-on-year to $122 million, reflecting continued demand for vinyl records.

Here are some helpful anecdotal comments from CEO Steve Cooper on the company’s most recent musical hits and deals, made during his prepared remarks on the second quarter earnings call:

We are always developing the next wave of culture-shaping music that will create the soundtrack of tomorrow. For example, Gayle kicked off the year with the world number one smash ABCDEFU and Jack Harlow’s new single First Class debuted at number one on the Billboard Hot 100 last month. Dua Lipa and Megan Thee Stallion racked up over 40 million streams in just one week with their hit collaboration Sweetest Pie.

Our publishing team also continues to excel with an impressive 90 songs charting on the Billboard Hot 100 in the second quarter. Some of the biggest hits our songwriters have contributed to this quarter are Smoking Out the Window by Silk Sonic, Desperados by Rauw Alejandro and Starlight by Dave. Warner Chappell had a stellar performance at this year’s Grammys. Along with Bruno and Anderson, who are also songwriters for Warner Chappell, we saw big wins for Chris Stapleton for Best Country Song and Ojivolta for Best Rap Song. Warner Chappell wins highly competitive contracts to attract talent from around the world and from all musical backgrounds. From Nigeria, Tay Iwar to Italy, Sick Luke, to the United States, Nicolle Galyon.

In March, we signed two important agreements with Patrick Moxey, the founder of Dance Label Ultra. Warner Chappell now administers Ultra’s 6,000 copyrights across Europe, including songs by Drake, Rihanna and The Weeknd among many others. And Warner has also entered into a strategic alliance with Patrick’s legendary Payday Records as well as his new label, Helix.”

Cooper further added that the music industry grew 18.5% in 2021, but Warner Music Group outperformed that benchmark by 250 basis points.

Adjusted EBITDA for the quarter also increased 5% year-over-year to $282 million. The slight decline in EBITDA margins to 20.5% (90 basis points lower than 21.4% in the prior year quarter) was driven by revenue mix as the recovery in artist services revenue ( which generate a lower gross margin of around 20%) weighed on the overall revenue profile.

Key points to remember

As one of the leading music producers that has continually proven itself capable of adapting to the times (both discovering popular new artists and adjusting its business model in the digital age), I continue to view Warner Music Group as a “forever company” at a reasonable valuation. Buy this dip and hold on for the long haul.

Comments are closed.